Companies can use the expertise of EY to help them with finance and tax. They help their clients manage risk and improve value. EY's investments into people, processes, technology, and infrastructure can also be a benefit to them. Companies can be more focused on their core tax activities by cosourcing finance and taxes.

Flynn Flynn is the Americas Vice Chair of Tax at Ernst & Young

Ernst & Young has named Kevin Flynn as the Americas Vice Chair of Tax. He will be based in San Francisco and will oversee the firm's tax strategy and client services. Flynn joined EY 35 years ago. Prior to this role, Flynn worked as an Associate Vice President for the firm's US Tax practice. He is a member of American Institute of Certified Public Accountants.

Flynn, in addition to his role of Americas Vice-Chair of Tax, is also Americas Managing Partners of the firm’s Tax practice. He graduated from Cal Poly San Luis Obispo where he studied Public Policy.

He is also a member of American Institute of Certified Public Accountants

Tax ey is a firm that specializes in tax planning and preparation for businesses. They have a strong background and expertise in international taxes planning. They are also members of American Institute of Certified Public Accountants.

A Chartered Global Managerial Accountant (CGA) and a Certified Public Accounting Assistant lead tax ey. He has a B.A. in accounting and a Master of Business Taxation from the University of Southern California. He is a member of both the American Institute of Certified Public Accountants as well as the Real Estate Association of Latinx Professionals. He is also a member of the Women's Economic Forum Silicon Valley chapter. His work history includes being the Trumpet Squad Leader of the USC TrojanMarching Band. His performances can be seen on Coachella's Mainstage and in the film Glee. He also played in the Los Angeles Lakers' band from 2010 through 2013.

In 2017, Ken Dawson joined Ernst & Young’s National Tax Office. He is skilled in the areas of income tax and deduct accounting, long-term contract, leasing, and accounting foreign controlled corporations. He was previously a Tax Policy advisor at the U.S. Department of Treasury Office of Tax Policy. He was also a member of the Celia Berta Gellert Foundation and Carl Gellert Foundation boards.

FAQ

What was the origin of modern consultancy?

Accounting professionals were the first to become consultants. They helped companies manage their finances. Their skills in managing financial information led to them being called "accounting consultant". The role soon expanded to include other areas, including human resources management.

The French word meaning "to advise" in French is what gave rise to the term "consultant". This term was originally used by businessmen to denote someone who could give guidance on how to run an enterprise. Even today, many business owners still use "consultant" when referring to professional advisors.

What tax do I have to pay on consulting income?

Yes. You will have to pay taxes on your consulting profits. This amount will depend on how much you earn each year.

If you're self-employed, you can claim expenses on top of your salary, including rent, childcare, and food.

But, interest payments on loans, vehicle and equipment depreciation will not be allowed to be deducted.

You cannot claim back less than PS10,000 in a given year.

You might be taxed even if you make more than the threshold depending on whether your income is contractor or employee.

The tax system for employees is PAYE (pay-as-you earn), while VAT is applied to contractors.

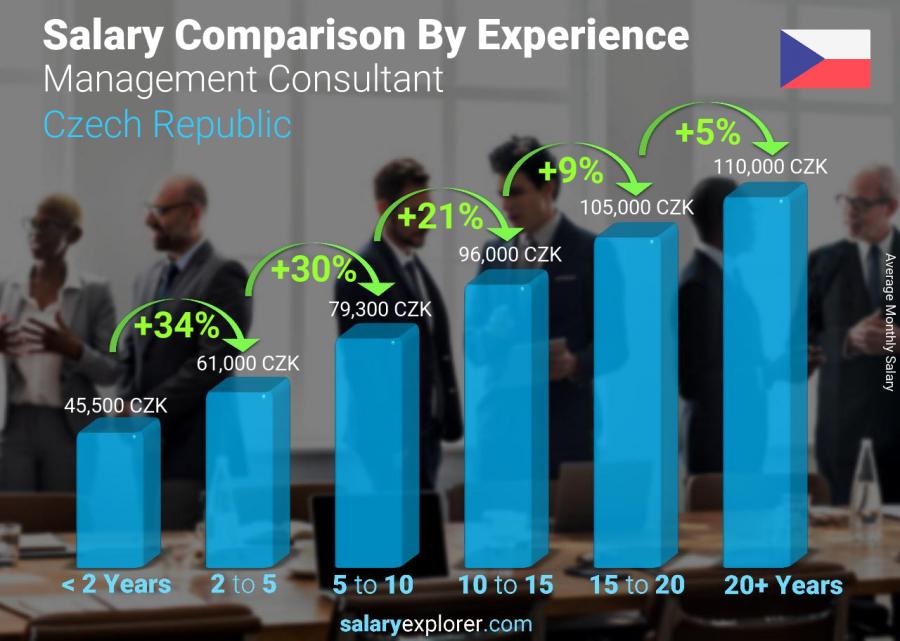

How much do consultants earn?

Some consultants make over $100k per year. However, most consultants only make $25-$50k. The average consultant salary is $39,000 This includes both salaried and hourly consultants.

Salary depends on the experience of the consultant, their location, industry, type and length of the contract (contractor or employee), as well as whether they have their own office or work remotely.

Statistics

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

External Links

How To

How to Start a Consultancy Company and What Should I Do First

Start a Consulting Company to make some extra money from home. You don't need any previous business experience or investment capital. A good place to start your own consulting company is to build a website. To promote your services, you will need to create a website.

With these tools, you can put together a marketing plan that includes things like:

-

Content creation (blogs).

-

Contacts are essential for building relationships

-

Generating leads (lead generation forms).

-

Selling products (eCommerce websites)

After you have developed your marketing strategy, it's time to find clients willing to pay for your services. Some prefer to connect with people through networking events. Others prefer to use online resources like Craigslist and Kijiji. The decision is up to each individual.

Once you have secured new clients, you will need to discuss terms with them and their payment options. You can discuss hourly rates, retainer agreements, flat fees, and other options. It is important to clearly communicate with clients before you accept them as clients.

An hourly contract is the most popular type of contract for consulting services. This agreement allows you to agree to provide services at a fixed price each week or month. Based on the service you provide, you might be able to negotiate a discount based on the length of your contract. Make sure you understand what you are signing when you accept a contract.

Next, create invoices. Send them to your clients. Invoicing can be a complicated task until you actually attempt it. You have many options to invoice your clients. Some people prefer to email their invoices directly, while others prefer to mail them hard copies. Whatever your preferred method, make sure it works well for you.

Once you have completed creating invoices you will want to collect payment. PayPal is preferred by most because it is easy-to-use and offers multiple payment options. Other payment processors, like Square Cash or Google Wallet, Square Cash or Apple Pay, Venmo and Venmo are also available.

Once you're ready to begin collecting payments, you'll want to set up bank accounts. Separate savings and checking accounts will allow you to track your income and expenses independently. Automated transfers into your bank account are a great way to pay bills.

Although it can seem daunting when you first start a business as a consultant, once you get the hang of it, it will become second nature. For more information on starting a consultancy business, check out our blog post here.

It's a great way for extra income without having to worry about hiring employees. Many consultants work remotely. This means that they don’t have to deal in office politics or work long hours. Because you don't have to work a set number of hours per week, you can be more flexible than a traditional employee.