You're not the only one interested in a career as a bank consultant. Many bank executives have worked for decades, so they are well-versed in how to navigate the political environment and keep their clients happy. However, top bank consultants have made great sacrifices for their clients and are long-time professionals with industry knowledge.

Qualifications to become a bank consultant

Bank consultants are responsible for advising customers on financial products, services and providing information. They may also help customers apply for a loan or manage their accounts. Senior colleagues usually supervise consultants. They work a standard 9-to-5 schedule and do not work evening or weekend shifts.

A bank consultant should have excellent communication skills and financial knowledge. A bank consultant must be able to analyze well and be motivated. Good computer skills are also essential. This job requires you to travel. The job can be extremely rewarding and offers attractive benefits as well as a salary. This career is for you if you're interested. Read on to find out more about the requirements and qualifications.

Consultants work in diverse teams and have the opportunity to interact with senior executives. They will also receive unmatched exposure. They will become part of a team, and can make a significant impact on the bank's operations. In a typical consulting role consultants work in small groups to identify and implement solutions. They might even participate in implementation.

Job description

A banking consultant assists banks with various tasks like preparing documents or helping customers get loans. They must be able communicate effectively and have a solid understanding of financial information. In addition, they must have problem-solving skills. These skills are highly sought after as they help banks adapt to changing technologies.

A banking consultant aids financial institutions with managing risk, improving service and creating new products. They can also assist clients with making informed decisions about bank relationships. Typically, these professionals have a background in economics or finance. Some professionals might hold certifications such as FINRA or IARBC. They typically work during regular business hours and do not work on weekends.

The perfect job description for a consultant in banking will emphasize the most important skills and qualifications. The job description should include details such as the company's culture, values and career paths.

Salary

There are many salaries available for banking consultants positions in the United States. ZipRecruiter reports that this occupation has an average annual salary of $73,900 to $188,000. However, the highest-paying locations may offer a higher salary than the national mean. In Saint Helena, CA, the median annual salary for Banking Consultants is $84,673, which is nearly $15,000 more than the national average. But, this average salary will likely vary depending on industry and experience.

If you can get a higher-paying job as a consultant, it may be worth leaving your full-time job. A senior consultant often earns a salary similar to that of a full-time employee. Furthermore, organizations often rely on consultants and interim professionals to fill in the gaps created by employee turnover. They assess potential full time hires and oversee strategic financial initiatives.

FAQ

How do you get clients for your consultancy business?

Finding a passion area is the first step. It can be anything you like, including public relations or social media. If this is the case, it may be worth starting small by focusing on a niche market such web design. Once you have found the niche market, you need to understand why it works. What problems can it solve? Why should people use them? But most importantly, what can you do to help them?

It is also possible to approach businesses directly.

You can also offer your services at events such as networking nights and conferences, if all else fails. You will meet potential customers and be able show your skills without having to spend money advertising.

How does consulting differ from freelancing?

Freelancers are individuals who work for themselves and offer their services to clients. They generally charge an hourly rate depending on how long they spend on a client project. Consultants are usually employed by companies or agencies. They are often paid monthly or annually.

Consultants often have more flexibility, while freelancers can choose to work when they want and set their own rates. Consultants, however, often have better benefits such as retirement plans, vacation days, and health insurance.

Who hires consultants

Many organizations hire consultants to assist with projects. These include small businesses, large companies, government agencies and non-profits.

Some consultants work directly with these organizations while others freelance. The hiring process will vary depending on the complexity and size of the project.

Before you can hire a consultant, there will be several rounds of interviews.

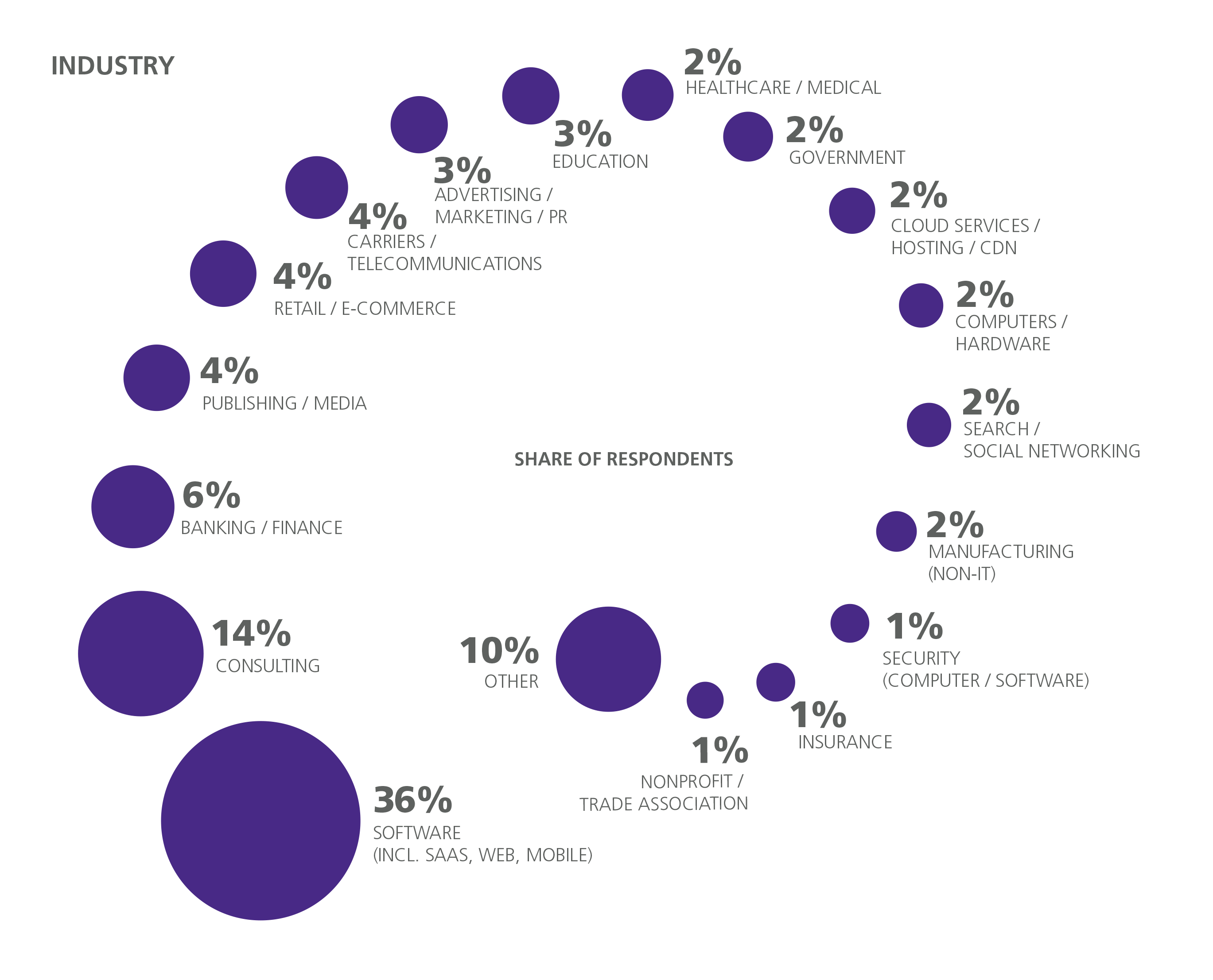

Which industries employ consultants

There are many different types. Many consultants specialize in a particular type of business. Others may be more focused on multiple types.

Some consultants work only for private companies, while others represent large corporations.

Many consultants also work internationally to assist companies from all corners of the globe.

Is it possible for a consulting business to be run from home?

Absolutely! In fact, many consultants already do exactly this.

Many freelancers work remotely via tools such as Skype, Trello and Basecamp. To avoid being left out of company perks, they often set up their own office space.

Some freelancers prefer working in cafes and libraries over traditional offices.

Some choose to work remotely because they are surrounded by their family.

Although working from home is a great option, there are some downsides. It's worth looking into if your job is fulfilling.

How do I become successful as a consultant?

First, find a subject you're passionate about. Next, you need to establish relationships. It is important to understand the needs of clients and their business. Finally, you have to deliver results for your clients.

While you don’t have to be the greatest at everything, you have to be better than everyone else. Passion is key. It's not enough to just say "I want to be a consultant." You have to believe in yourself, and in what you are doing.

What are the benefits to being a consultant?

As a consultant, you can usually choose when you work and what you work on.

This allows you the freedom to work wherever you like, whenever you want.

This allows you to easily change your mind and not worry about losing your money.

You can finally control your income and create your own schedule.

Statistics

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

External Links

How To

What Does A Typical Day For A Consultant Look Like?

Depending on what type of work you do, your typical day may vary. However, the majority of your day will consist of research and planning, meeting clients and preparing reports.

You will have many meetings where clients and you can discuss their issues. These meetings can be held over the telephone, online or face-to face.

The proposal is a document that outlines your ideas and plans to clients. These proposals should be discussed with a mentor or colleague before being presented to clients.

After all the planning and preparation, you will have to produce some content. You might be creating articles, videos, editing photos, writing interviews, or designing websites.

It depends on the project's scope, you might need to do some research to collect relevant statistics. For example, you may need to find out how many customers you have and whether they are buying more than one product or service.

After gathering enough information, you can present your findings to clients. You can either present your findings in writing or orally.

Finally, you must follow up with clients after the initial consultation. You could phone them occasionally to check on things or send an email asking them to confirm that you have received their proposal.

This process takes time, but it's important to ensure that you stay focused and maintain good relationships with clients.